As bond markets move, so do we.

Your fixed income partner of choice.

Access the bond markets with our comprehensive and cost-effective fixed income ETFs.1

Benefit from our scale and expertise.

Compelling

>85 ETF+ with €60bn AuM2

Access our broad range of fixed income ETFs to achieve your strategic and tactical fixed income objective.

Cost-efficient

Management fees starting at just 0.05%1

Harness one of the most competitively priced fixed income ETF ranges in the European market3.

Responsible

Launched world’s first Tilted Green

Bond ETF4

Invest responsibly with Amundi ETF, one of Europe’s leading providers of responsible investment solutions3.

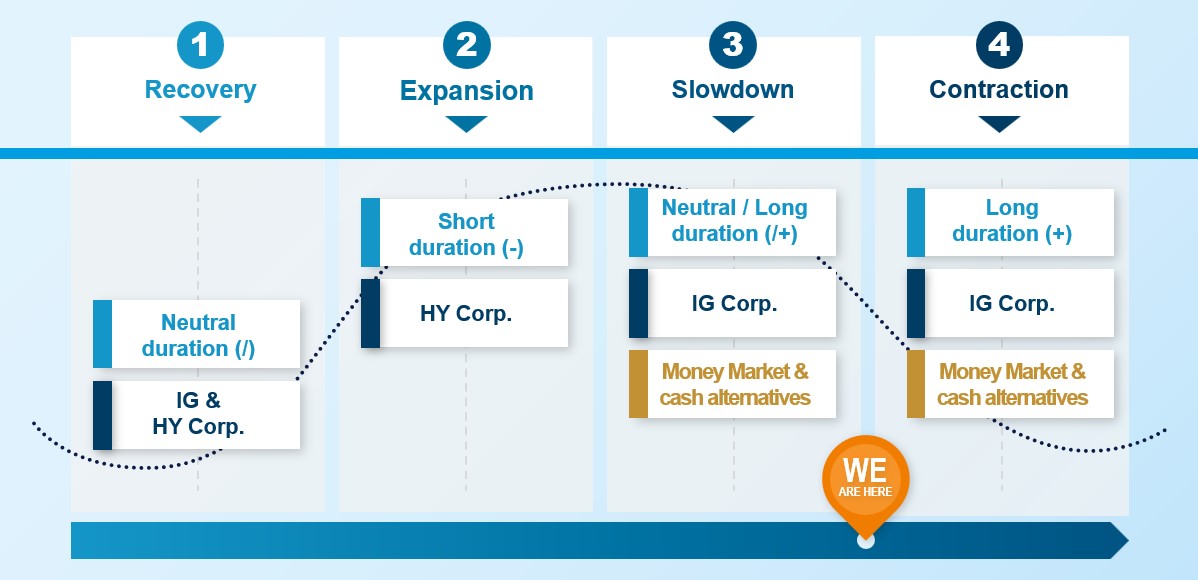

Positioning your fixed income portfolio in the economic cycle.

Our innovative solutions can help you adapt to changing economic cycles, ensuring you can confidently navigate the bond markets.

No matter the environment, we have a fixed income ETF for you.

As markets evolve, you need access to the right solutions at the right time, from core ETFs to tactical tools.

Source: Amundi – November 2025. Past performance is not a reliable indicator of future performance. Information is given for indicative purposes only and may change without prior notice.

Meet your fixed income objectives with our ETFs.

Amundi ETF offers a comprehensive range of fixed income solutions to help you navigate every market cycle.

Whatever the economic environment, we have an ETF for your dynamic portfolio.

MONEY MARKET CASH ALTERNATIVES

Bringing complementary short-term solutions:

From “Low risk profile” to “Step out of cash

DURATION

MANAGEMENT

CREDIT

RESPONSIBLE

Shift from a traditional exposure to an SFDR Article 8 solution

TACTICAL

Seize timely opportunities and be nimble in changing conditions

Unlock the full potential of bond investing.

Source: Amundi, April 2025. Information given for indicative purposes only, may change without prior notice. Information on Amundi’s responsible investing can be found on amundietf.com and amundi.com. The investment decision must take into account all the characteristics and objectives of the fund, as described in the relevant Prospectus.

For more details regarding the investment objective of the funds, please refer to the KID or prospectus. Investment involves risks. For more information, please refer to the Risk section at the end of the document.

Discover our latest fixed income insights.

Read our blogs:

Watch our videos:

Webinars:

45 min

Rethinking European Fixed Income

Access the replay of our webinar during which we will explore how global developments are shaping the fixed income landscape, featuring experts from the Amundi Investment Institute and special guest Peter Praet, former Chief Economist and Executive Board Member of the European Central Bank.

Watch our latest Amundi ETF Bond Briefing Webinar!

As investors reallocate to Europe from the US in equities, we see a similar trend in fixed income. With European countries recalibrating their policies, our experts highlight the opportunities in the region’s corporate credit and government bond markets.

Source: Amundi.

1. Source: Amundi, September 2025. Management fees refer to the management fees and other administrative or operating costs of the fund. For more information regarding all the costs supported by the fund, please refer to its Key Information Document (KID). Transaction cost and commissions may occur when trading ETF.

2. Data as at end of September2025.

3. Source: ETFGI, September 2025.

4. Source: Amundi, based on similar strategies available in the UCITS ETF Market. Information given for indicative purposes only, may change without prior notice.